Financial

Relations between Centre & States

Topics Discussed: -

·

Introduction

·

Distribution of Tax Revenue

·

Grants-in-Aid

·

Effect of emergencies on Centre-State Financial Relations

·

Objectives

·

Introduction

ü Generally, in typical federation along with the distribution of

legislative and administrative powers, the financial resources of the country

are also so distributed as to ensure financial independence of the units.

ü However, the Indian Constitution does not make a clear cut

distribution of the financial resources and leaves much to be decided by the

Central Government from time to time.

ü The financial resources which have been placed at the disposal of

the state are so meagre that they have to look up to the Union Government for

subsidies and contributions.

ü Article 268 to 293 in Part XII deal with the financial

relations.

·

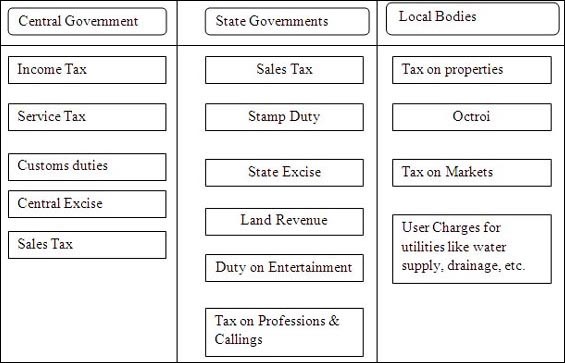

Distribution

of Tax Revenue

ü Duties Levied by the Union but Collected and Appropriated by the States: Stamp

duties on bills of Exchange, etc., and Excise duties on medical and toilet

preparations containing alcohol. These taxes don’t form the part of the

Consolidated Fund of India, but are assigned to that state only.

ü Service Tax Are Levied by the Centre but Collected and

Appropriated by the Centre and the States.

ü Taxes Levied as Well as Collected by the Union, but Assigned to

the States: These include taxes on the sale and purchase of goods in the

course of inter-state trade or commerce or the taxes on the consignment of

goods in the course of inter-state trade or commerce.

ü Taxes Levied and Collected by the Union and Distributed between

Union and the States: Certain taxes shall be levied as well as collected

by the Union, but their proceeds shall be divided between the Union and the

States in a certain proportion, in order to effect on equitable division of the

financial resources. This category includes all taxes referred in Union List

except the duties and taxes referred to in Article 268, 268-A and

269; surcharge on taxes and duties mentioned in Article 271 or any

Cess levied for specific purposes.

ü Surcharge on certain duties and taxes for purposes of the Union: Parliament may at any time increase any of the duties or taxes referred in those articles by a surcharge for purposes of the Union and the whole proceeds of any such surcharge shall form part the Consolidated Fund of India.

·

Grants-in-Aid

The

constitution provides grants in aids to the states from the Central resources.

There are two types of grants: -

1.

Statutory Grants: These grants are given by the Parliament out of the

Consolidated Fund of India to such States which are in need of assistance.

Different States may be granted different sums. Specific grants are also given

to promote the welfare of scheduled tribes in a state or to raise the level of

administration of the Scheduled areas therein (Art.275).

2.

Discretionary Grants: Centre provides certain grants to the states on the

recommendations of the Planning Commission which are at the discretion of the

Union Government. These are given to help the state financially to fulfil plan

targets (Art.282).

·

Effect of

emergencies on Centre-State Financial Relations

Ø During

National Emergency: The

President by order can direct that all provisions regarding division of taxes

between Union and States and grants-in-aids remain suspended. However, such

suspension shall not go beyond the expiration of the financial year in which

the Proclamation ceases to operate.

Ø During

Financial Emergency:

Union can give

directions to the States: -

1. To observe such canons of financial propriety as

specified in the direction.

2. To reduce the salaries and allowances of all people

serving in connection with the affairs of the State, including High Courts

judges.

ü To reserve for the consideration of the President

all money and financial Bills, after they are passed by the Legislature of the

State.

·

Finance

Commission

Ø Although the Constitution has made an effort to allocate

every possible source of revenue either to the Union or the States, but this

allocation is quite broad based.

Ø For the purpose of allocation of certain sources of revenue,

between the Union and the State Governments,

the Constitution provides for the establishment of a Finance

Commission under Article 280.

Ø According to the Constitution, the President of India is

authorized to set up a Finance Commission every five years to make recommendation

regarding distribution of financial resources between the Union and the States.

Members

A.

Finance

Commission is to be constituted by the President every 5 years. The Chairman

must be a person having ‘experience in public affairs’. Other four members must

be appointed from amongst the following: -

B.

A High

Court Judge or one qualified to be appointed as High

Court Judge.

C.

A

person having knowledge of the finances and accounts of the Government.

ü A person having work experience in financial matters

and administration.

ü A person having special knowledge of economics.

Functions

The Finance Commission recommends to the President

as to: -

1. The distribution between the Union and the States

of the net proceeds of taxes to be divided between them and the allocation

between the States of respective shares of such proceeds;

2. The principles which should govern the

grants-in-aid of the revenue of the States out of the Consolidated Fund of

India;

ü The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State

Comments on “Financial Relations between Centre & States”